in tandem with investment, or joint investment in businesses or assets with high growth potential. The Company’s goal is to be the top property developer dedicated to creating quality projects and new lifestyles for people to live, play, work and shop, together with nurturing growth and delivery of sustainable value to all stakeholders, and that fulfill the needs of living, leisure, working and shopping, and delivers the sustainable growth to all stakeholders.

SINGHA ESTATE WAS FOUNDED ON

The main objective was to engage in property development for housing estates and condominiums. The Company later underwent a name change to Rasa Property Development Public Company Limited (“Rasa”), with listing on the Stock Exchange of Thailand (SET) since 12 April 2007, under the “RASA” ticker symbol.

Then on 12 September 2014, the Company completed its business integration, by way of entire business transfer, with group of companies under the Singha Property Management Company Limited, and Mr. Santi Bhirombhakdi. The shareholding structure also underwent change: Singha Property Management (in which Boon Rawd Brewery Company Limited holds 99.99% shares) and Mr. Santi Bhirombhakdi became the major shareholders.

On the same day, its name changed to Singha Estate Public Company Limited , which changed its ticker symbol on The Stock Exchange of Thailand from “RASA” to “S” .

OUR BUSINESSES

RESIDENTIAL

The Company engages in high-rise and low-rise residential property development across various models, offering a diverse range that includes single detached houses, cluster homes, home offices, and condominiums. These projects cater specifically to the high-end market under diverse brands encompassing all segments of luxury housing. Details are as follows:

Single Detached Houses

Condominiums

Cluster Homes & Home Office

HOSPITALITY

The Company operates its hospitality business through S Hotels and Resorts PCL (SHR), its subsidiary which the Company directly and indirectly holds in an aggregate of 62.24%.

SHR is a holding company that engages in the hotel development and management business. The Company operates through strategic investments in fast-growing international hotel businesses, actively seeking opportunities to expand its business and partnerships with investors in ventures and assets exhibiting significant growth potential.

SHR is committed to establishing industry-leading standards for both leisure and quality of living by offering the best products and services that create value and enrich the travel experience in affordable luxury hotels and resorts. Our dedication to excellence extends to upholding the highest standards of safety and hygiene across all operations. Recognizing the importance of environmental and social responsibility, SHR fosters positive relationships with local communities and implements sustainable practices throughout our business activities.

COMMERCIAL

Commercial business, consisting of office spaces and retail spaces, is one of the Company’s core businesses that generates recurring income, offering good returns on investment and high growth potential. The Company plans to expand commercial business by developing its own commercial projects and through acquisition. The main revenue contribution of this business consists of rental, utility charges and security service fees as well as fees for other supplementary services, and income from commercial property management in case the property leasehold is transferred to a trust established by the Company.

The Company’s decision whether to develop or invest in commercial projects depends on the suitability of location, restrictions, if any, on development or project, local supply and demand, returns on investment and growth potential.

Currently, the Company manages 5 commercial real estate projects:

- The Lighthouse, featuring small-scale retail spaces

- Suntowers office building acquired through a complete business transfer in August 2015

- Singha Complex, a Grade A office building and retail development self-initiated and fully operational since October 2018

- S Metro office building acquired in January 2020

- S OASIS, the Company’s latest Grade A office building and retail space, designed as a Smart and Eco-friendly Building.

INDUSTRIAL ESTATE & INFRASTRUCTURE

The Company’s business plan lays out a roadmap for diversification and expansion into new businesses in search of new revenue streams. The Company invested in the industrial estate and infrastructure business through S.IF., its wholly owned subsidiary. In 2021, S.IF. has invested in industrial estate business by acquiring ordinary shares of SIE, a company engaging in industrial estate development and invested in power generation by acquiring shares in BPAT1, BPAT2 and BPAT3, which are companies that operate power plant development business, including co-generation and power distribution.

S Angthong Industrial Estate spans approximately 1,790 rai and includes infrastructure development such as three co-generation power plants ("BPAT1 – 3"). These facilities will generate and supply electricity to industrial users within the estate.

Concurrently, the S.IF. Group will develop other utilities required by industrial users in S Angthong Industrial Estate, thereby generating additional steady revenue streams. Investment in industrial estate and infrastructure business is considered part of the Company’s diversification of business risks, improving resilience by creating new revenue streams while widening the Company’s capabilities by utilizing its broad-based real estate development expertise.

information as of 30 September 2025

Total

Total

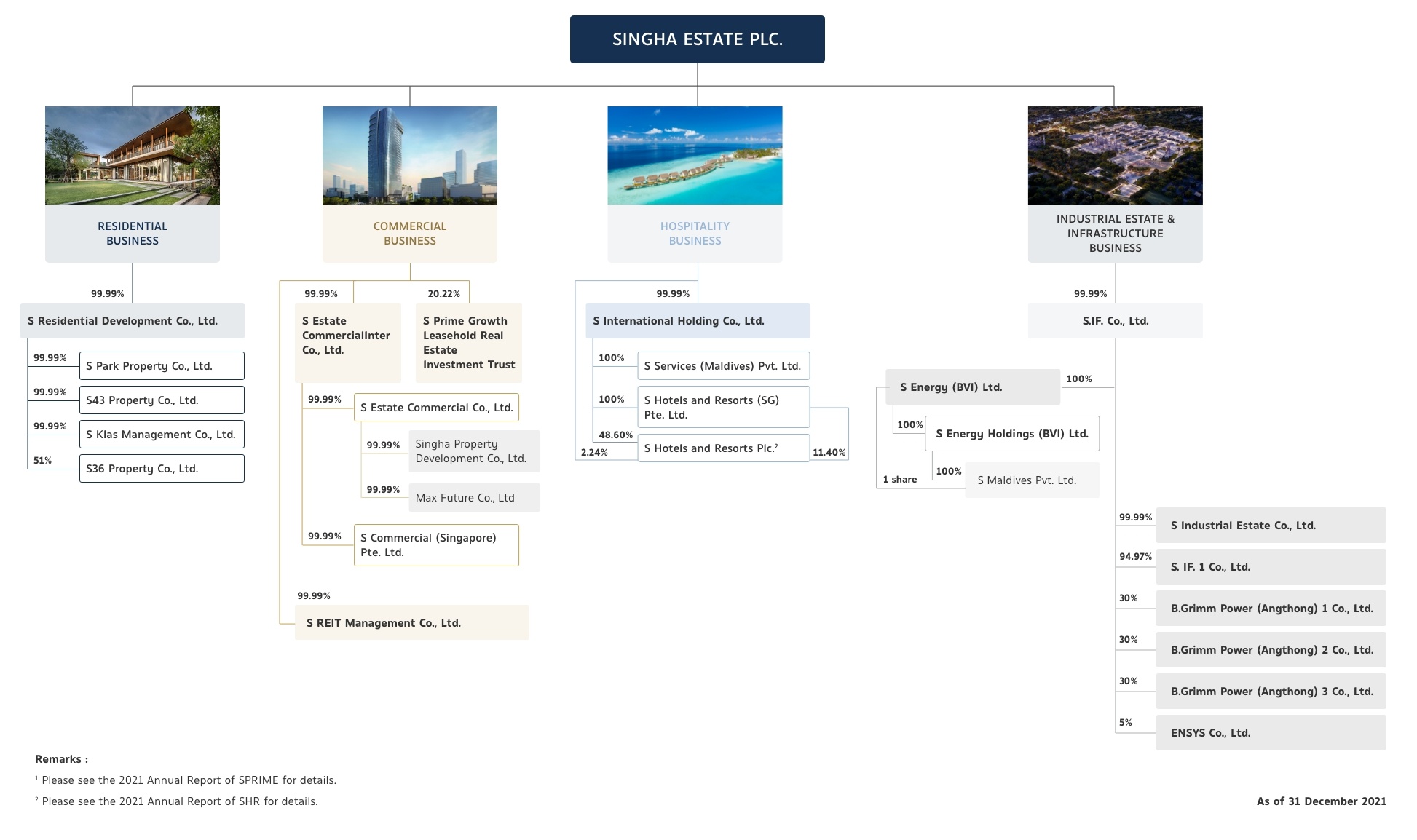

BUSINESS STRUCTURE

The operational restructuring and steady business expansion, as a result the Company has 4 core businesses, as follows:

BUSINESS DIRECTION

The Company operates its business by attaching to the direction and corporate strategy striving to be an entrusted and value enricher, along with the business and functional strategy to be more in accordance with and responsive to the changing dynamics.

KEY MILESTONES

under the name “Singha Estate Public Company Limited”

- February 2025 : Officially launched 3 new projects. 2 cluster-home projects under brand SMYTH's and 1 condominium JV, One River Rama III project.

- June 2025 : Enabled to successfully close sales for 2 projects total value approximately THB 3,000 million which were SIRANINN Residences Pattanakarn, a Super Luxury single-house project and the SENTRE Pattanakarn Multi-Use Home Office.

- August 2025 : Officially launched S'RIN Prannok-Kanchana, a premium luxury single-detached house. Price starts from THB 45 - 80 million, total project value THB 4,337 million.

- Announced a strategic partnership with The Ascott Limited which hotels in Edinburgh and Leicester will rebrand into The Unlimited Collection and hotels in Glasglow and Manchester will rebrand into Lyf.

- May 2024: Launched two new luxury detached house projects under the SHAWN brand: SHAWN Panya Indra and SHAWN Wongwaen - Chatuchot

- Received a BBB+ corporate credit rating from TRIS Rating

- Introduced new brands and low-rise housing projects such as LA SOIE De S, SMYTH’s, S’RIN, and SHAWN, expanding Singha Estate’s comprehensive brand coverage across all luxury segments

- Soft-opened SO/ Maldives, the third luxury resort at CROSSROADS Maldives

- Commenced commercial operations (COD) of all three co-generation power plants at S Angthong Industrial Estate, with a total capacity of 400 megawatts.

- Disposed nonperforming of UK hotel assets according to Asset Rotation Strategy. The proceeds derived from such disposition are planned to be further invested in the improvement and development of the core assets of SHR Group.

- Launched of SIRANNINN THE RESIDENCES.

- Announced the soft opening of S OASIS, its latest office building, distinguished by innovation and sustainability, and certified with LEED Gold V4 certification

- Increased stake and became a single shareholder of 26 UK hotel portfolio under Mecure Brand

- Converted 3 Outrigger hotels, 2 in Thailand and 1 Maldives to Self-managed platform

- Signed a hotel management agreement with SO/ Hotels & Resorts, to develop and operate the 3rd resort under the CROSSROADS project 100% Sold out SANTIBURI THE RESIDENCES Expanded the business to industrial estates and infrastructure

- Expanded the business to industrial estates and infrastructure

- Launched of The EXTRO, premium luxury condominium

- Disposed all ordinary shares of NVD to allow S to develop landed property under our own management

- Disposed 30Yr leasehold right of SUNTOWER to SPRIME

- Became Thailand Sustainability Investment or “THSI“

- Spin off hospitality business – “SHR”

- Launched of CROSSROADS project, the first integrated tourist facilities project on Emboodhoo Lagoon in the Republic of Maldives.

- Launched SANTIBURI THE RESIDENCES

- Started development of S OASIS

- Grand opening of Singha Complex

- Acquisition of six hotels under OUTRIGGER brand

- Launched The ESSE at Singha Complex

- Launched The ESSE SKV 36, JV with Hongkong Land

- Completed RO of 738,382,027 ordinary shares at THB 5.00/share

- Invested in a 3 HOTEL PORTFOLIO in UK through a 50%-stake joint-venture company

- Invested in 51% stake of NIRVANA

- Launched THE ESSE ASOKE

- Invested SUNTOWER

- Invested in 26 HOTELS under “Mercure” brand IN UK through a 50%-stake joint-venture company

- EGM resolution to approve THB 4,712 million CAPITAL INCREASE, change of shareholder structure and approve a change of company name from “RASA Property Development Plc.” to “Singha Estate Plc.”

- Acquired of PHI PHI VILLAGE BEACH RESORT

SUSTAINABILITY DEVELOPMENT

Sustainability strategy is the cornerstone of Singha Estate's business concept. It aims for sustainable growth in business, society, community, and the environment, proactively driving sustainability efforts under the vision of 'Go Beyond Dreams' and guided by the strategic approach of 'Go Exceed, Go Exist', which encompasses three main pillars."

- Carbon neutral roadmap (Target NDC >40% )

- S.IF. renewable energy solar cell contribute target >20% of total emission

- Leader of sustainable luxury

- 21 IUCN red list species

- The largest marine conservation area in Indian Ocean (OECMs) 31.56% (3,150,000 sq.m.)

- Target forestation 1,000,000 sq.m. in 2025 at Singha Park

- Phi Phi creates share value for the executives' program

>100K people engagement

- S.IF. social enterprise carbon sink project - 4 provinces (97 Moo Ban)

- Capacity building and knowledge sharing with Maldives Ministry

- Build conservation mindset through CRM

- Green supply chain